Government Bond Loans State by State

From the Desk of the Chief Economist

The Australian rental market can be a challenging landscape to navigate, particularly due to recent supply shortages and price increases. Below is a state by state breakdown of current available Government Bond Loans that are available to those who require assistance.

Queensland

Bond Loan - Interest-free and fee-free bond loan to cover the rental bond when you move into a private rental accommodation.

Bond Loan Plus - Interest-free and fee-free loan to cover the rental bond PLUS an amount equal to 2 weeks rent for the property you want to rent.

Rental Grant- One-off grant of 2 weeks rent for people in a housing crisis. It assists with payments for costs of moving to private rental accommodation.

Eligibility Criteria:

- You do not currently live in the property that you need a bond for

- You are an Australian citizen or permanent resident or have a temporary protection or bridging visa

- You do not own or part-own:

- A residential property

- A caravan, mobile home or live-aboard boat permanently connected to household utilities

- You have less than $2500 in cash or savings among all the Bond Loan applicants (not including dependents)

- You don’t have outstanding debts with the state government

- You are choosing a property where the rent is not more than 60% of the total gross weekly income of all applicants

For more information visit: qld.gov.au

New South Wales

Rentstart Bond Loan - NSW Department of Communities and Justice (DCJ) operates Rentstart. It provides financial assistance for eligible clients to help them set up or maintain a tenancy in the private rental market. Clients may be able to be assisted with a loan of up to 100% of their rental bond. The loan is interest-free and repayable to DCJ Housing. Any payments you make can be returned to you at the end of the tenancy if there is no claim made by the landlord or real estate agent.

You are eligible if:

- You are eligible for social housing

- You have less than $3000 in cash assets

- You are able to sustain a tenancy in the private rental market

- Rent for the property you wish to rent is not more than 50% of your household’s total gross weekly income. For example, if your household’s total gross weekly income is $500, to be eligible for a Rentstart Bond Loan, the weekly rent must be $250 or less

Rentstart also provides further financial assistance in the rental market to set up and maintain tenancy through:

- Advance Rent – already have Rentstart bond loan but find it difficult meeting tenancy setup costs

- Rentstart Move – for those that want assistance leaving public housing or are no longer eligible for it

- Tenancy Assistance – once-off payment to help clients who have fallen into arrears with rent/water bills

- Temporary Accommodation – short term measure to provide accommodation for homeless clients

For more information visit: facs.nsw.gov.au or service.nsw.gov.au

Tasmania

Bond Assistance - Found through the Department of Communities Tasmania Housing Connect website. Housing Connect can give financial assistance once every 12 months.

They will ask you to provide information that shows that you:

- Live in Tasmania, not another state or territory

- Are an Australian Citizen or Permanent Resident

- Are 16 years or older

- Are a low-income earner who is eligible to keep a Low Income Health Care Card

- Do not have assets that could be used to meet your housing needs

For more information visit: tas.gov.au

Victoria

RentAsssist bond loan - Tenant must meet the department’s eligibility criteria to be approved for a bond loan. Those include:

- Meeting bond loan income and asset eligibility limits

- Be a permanent Australian resident

- The proportion of rent is less than 55% of individual gross (before tax) weekly income

- Do not own or part-own a house, flat or unit

A bond loan amount is determined by the size of the property, the number of bedrooms and the number of people living in the property. The maximum bond loan amounts are:

- Bedsit or 1 bedroom $1,650

- 2 bedrooms $2,000

- 3 bedrooms $2,200

- 4 or more bedrooms $2,000

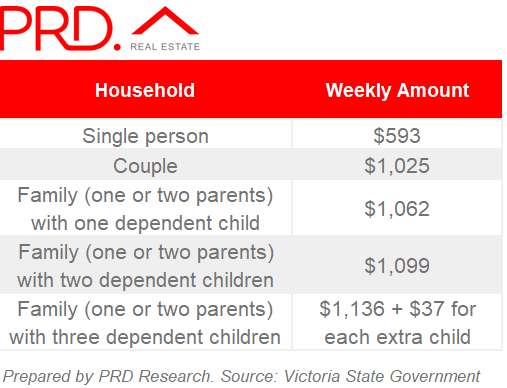

Weekly Income limits

If a single parent has regular access visits from their children for at least 21% of the year, the relevant 'Family with dependent children' income limits apply.

These limits go up by 1.1% every six months on 1 April and 1 October. This is to reflect increases in the general cost of living.

For more information visit: vic.gov.au and vic.gov.au/rentassist

South Australia

Bond Guarantees - Bond guarantees are lodged with Consumer and Business Services (CBS) and information is available under the South Australian Government ‘Private rental assistance program policy’. It is an undertaking that Housing SA will pay for verified, legitimate claims at the end of the tenancy.

Amount of Bond Assistance

- Customers moving into rooming or boarding houses may receive a bond guarantee of up to 2 weeks rent

- Customers moving into caravan parks may receive a bond of up to 4 weeks rent

- Customers moving into other types of accommodation may receive a bond of up to 4 weeks rent, or 6 weeks rent if the rent is more than $250 per week

Customers are eligible if they meet all the below conditions:

- They have an independent income

- They meet the income and asset limits for the program

- They provide proof of income, identity and rent

- The total rent for the property is no more than $450 per week

- The share of rent is no more than 50% of their total assessable income before tax

- The property is in South Australia

- They do not have a debt to Housing SA, or the debt’s less than $1,000

- An arrangement to repay a debt owed to Housing SA

- They do not have an interest in a residential property

Bond guarantees are not provided to customers who have already moved in except if either:

- It will replace an existing bond the customer paid for which will be used to pay rent arrears when it’s released

- A landlord is eligible for a bond increase or top-up under the Residential Tenancies Act 1995

- A bond is needed for a new lease agreement, for example, a sharer takes on more of the lease when someone moves out, the landlord didn't need a bond for the original lease agreement

Housing SA asks CBS to release a bond guarantee in full to Housing SA if the customer or landlord cannot be contacted within 4 months of the date the lease agreement ended.

If a property owner, agent, or landlord makes a claim against a bond guarantee, Housing SA may:

- Investigate the claim

- Check the claim is legitimate

- Dispute all or part of the claim

If all or part of a Housing SA bond is claimed, it becomes a debt the customer owes to Housing SA in line with the Account management policy. Bond claims made as a result of domestic abuse perpetrated by someone other than the customer is managed in line with Domestic abuse policy.

For more information visit: housing.sa.gov.au

Northern Territory

You can get up to four weeks rent as a security deposit and an option to cover two weeks rent in advance.

If you are sharing with other people, you can only apply for the amount of bond you will be required to pay.

You must meet the following conditions to be eligible to apply for bond assistance.

Exemptions may be made in priority circumstances. This can include people escaping family violence or sponsored refugees.

For Residency - you must be:

- An Australian citizen

- A permanent resident of Australia

- Hold a Special Category Visa or Temporary Protection Visa

- Be a resident in the Northern Territory for at least three months prior to putting in your application

Income

- You must declare all sources of income including income you may get from overseas

- The rent you will pay must not be more than 53% of your income

If you are eligible for Commonwealth Rent Assistance, this amount will be included in the income assessment, even if you have not applied for or received it.

Assets you will need to declare include:

- Any money you have in the bank

- Boats, caravans, quad bikes and other recreational vehicles

- Superannuation and rollover funds you have access to

- Compensation payments

- Any non-residential property or land that you can't live on

Assets not included are:

- Your personal belongings such as clothes

- Household contents such as a fridge, washing machine and furniture

- A car or motorbike you use as transport for work

You must repay the loan.

- Repayments will be based on your agreement with Territory Families, Housing and Communities

- Repayments must be at least $10 per week and the length of an agreement can not be more than 18 months

- You can choose to make larger repayments and pay off the loan quicker

- If your tenancy agreement ends, the bond amount payable to you can be used to repay any bond assistance you owe

- Your landlord or real estate agent can return this amount directly to the department

For more information visit: nt.gov.au

Western Australia

Bond Assistance Loan Scheme - The Western Australia Housing Authority offers bond assistance and two weeks rent in advance as an interest-free loan to help people obtain accommodation in the private rental market. The loan is repaid in regular payments of at least $25 per fortnight.

Alternatively, if you have paid the bond or two weeks rent in advance to the landlord or real estate agent, then the Housing Authority can refund this to you — but you must apply within eight weeks of payment of the bond or rent in advance and produce evidence of the payment to the landlord.

Applicants must meet Bond Assistance Loan Scheme income limits:

- You do not have assets above $2,500 for singles without dependents, $5,000 for singles with dependents and $5,000 for couples with or without dependents

- You must be 16 years or over

- Rent cannot be more than 60% of an applicant's gross income

For more information visit: wa.gov.au and wa.gov.au/housingoptions